Before I get going on the technical details, those of which any managerial accounting student could compute, I want to start with my conclusions:

Biggest winners from the minimum wage:

The workers that remain after it’s enacted

Large businesses

Politicians

Biggest losers from the minimum wage:

The poor

The average low-skilled worker

Young people and recent college graduates

Small businesses

I want you to think back to the early days of your accounting education, for me, it was freshmen year of college. I had a professor with the last name “Pergola” which we all nicknamed Dr. Pergatory. I’ll let you guess why that name might’ve been given…

But all names aside, she taught some good managerial accounting. Now I’ve created my own problem, but I imagine I can open any McGraw Hill textbook and find something the same relating to whether or not a business should invest in capital equipment.

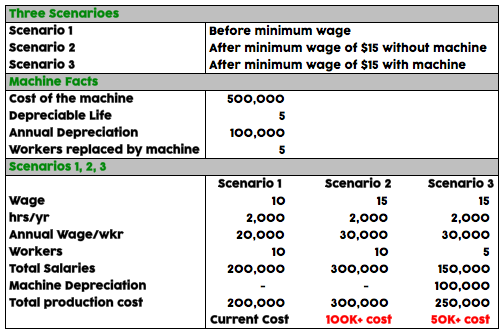

Here are the three scenarios related to the investment of a $500K machine (depreciable life of 5 years) and it could replace 5 workers:

In scenario 1, there is labor cost of 200K. If the business purchased the machine, they would save 100K/year per worker, but wouldn’t save anything as they have to replace the machine every 5 years.

The business may decide to do this as the machine likely has less liability associated with it’s use then workers. A machine can’t sue it’s employer, doesn’t ask for raises, and is generally covered by warranties from the manufacturer. However, for the sake of simplicity, let’s say in scenario on, there is a net zero gain or loss if the machine is purchased, therefore, the business carries on with all ten employees.

For scenario 2, things get tough for the business. With the new minimum wage of $15, the labor costs associated with production have risen by 50% and if prices don’t increase, that is a direct reduction in the bottom line. This creates scenario 3, where the business reassesses the need for capital investment in the labor saving machine. Now that the cost of labor has increased to $15/hr., investing in the $500k machine makes sense. Rather than lose $100K, the business can fire 5 workers, and only lose $50K.

With the cost savings won by the machine, and a slight increase in the prices of the products sold, the business will most likely return to profitability, however 5 workers are still out of a job.

And with the skills they had, finding a job will be harder than ever before. Every business is unique and goes through this same process every years, and sometimes more often than that!

Now I showed above that big businesses win, and small businesses lose. That’s because not many businesses have access to the capital markets to be able to raise/borrow the $500K investment needed to purchase the machine. In that case, they may have to raise prices more than the competition, which will reduce market share.

So why is this even being debated?

Simple: To win votes.

In ancient Rome the politicians used to do the same thing. Give out free bread to the masses of Rome, and they’ll reward you handsomely with votes. Bribery. Bribery at the expense of many for the enrichment of a few.

This is the exact opposite of the intended effect of the minimum wage.

It doesn’t help the poor. It destroys jobs and helps large companies take over even more market share.

Follow Us!