The controversy continues as I received quite a few comments/messages last week regarding whether you should consider an Online Masters Degree. Here’s one I wanted to share.

From the mailbag:

Hello Andrew!

My name is David, and I am currently studying for my CPA exam while going into my second year at a Big 4 accounting firm. The reason why I am interested in getting a master’s in tax is because I am currently in the audit practice and eventually I like to break away to freelance on my own practice.

I already have the 150 credits from my B.A. so the Masters in Tax is more so educational and help me advertise my future practice. Do you recommend getting a master’s in tax for this reason or would it just be a waste of money (not a great return on investment)?

Thank you,

David

I really don’t think this is a good plan.

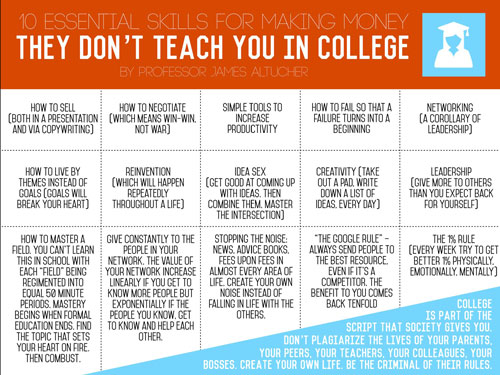

Degrees don’t give you the tools you need for entrepreneurship.

Here are some examples of things you’ll need when starting your business (and many are more important than any knowledge you will learn from a Masters in tax).

(full post from James Altucher here)

If I were in your shoes, the first thing I would do would be to get a few clients on the side while you keep you day job.

This is an amazing post written by a few entrepreneurial accountants about how they found their first 50 clients.

Once I built up 30-40% of my full-time income in my side-business, I’d quit.

I would plan to replace my full-time income within 6 months.

If I were in your shoes, I might consider a Masters in tax down the road after I got my business off the ground.

You’ve done a great job preparing.

You have worked at the Big 4.

You will shortly be a CPA (more important than a Masters in Tax when selling to clients).

The truth is, there are a ton of successful small business accountants that are about your age.

Here are a few to check out:

Thriveal – Community for Small Accounting Firms

Reach out to one or all of them and figure out their story.

You can also reach out to Chris Hooper at Accodex. He’s helping young accountants in the US and Australia who want to start their own CPA firm!

The point is that there are much more important steps on your goal to having your own tax firm and they are all things you can start TODAY!

Pass that CPA exam but as soon as that’s done, I would be looking to make the change ASAP.

Let us know how it goes!