Last week I talked a about How To Work Two Jobs Without Getting Fired and I got a TON of emails about it!

People want to know more about so many pieces of that story. But one of the main questions was:

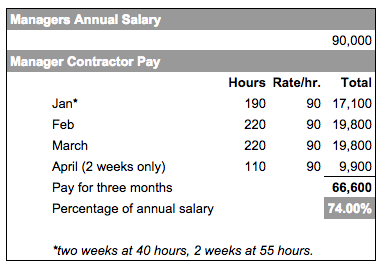

Can you really make 75% of an employee’s annual income in just 3 months working accounting busy seasons as a contractor?

Yes. In fact you can make even more!

I’m going to show you an example of a friend of mine who used to be a Big 4 manager. He made $90,000 a year, then quit to start his own company. Along the road, he hit some rough patches and decided to work as a contractor for a busy season.

I was able to help him negotiate a 90/hr rate. Oh by the way, that’s what I’ve been doing at Ten Key Heroes. Helping accounts find jobs as contractors!

Here are the financial details starting with the accounting salary:

This same concept applies to any level of accounting work, senior, senior manager, etc.

I know my calculation say ~66,000 and 75%, but we all know how things work in public accounting. Deadlines get pushed back, there are client delays, and what happens? You end up having to work EVEN more!

But, unlike when you’re salaried, every additional hour paid.

Get The CPA: It will help immensely if you want to be a contractor.

He also got all of his travel, room, and food covered by the firm and would be traveling about 70% of the time.

That means he has almost 9 months of the year FREE! Heck, he could just go bum out at the beach and make more than the median household income ($51K) in the US!

As an accountant working in public accounting, you have been gifted an INCREDIBLE opportunity. You can work a small portion of the year and make more than most entire families! So quit complaining!

People wonder, why would the firm do it? It’s actually a lot cheaper than you think.

Most of the money accounting firms make is during busy season. Then the rest of the year, they’re trying to find things for many of there staff members to do. In this scenario they don’t pay benefits (no healthcare, no 401k contributions, minimal training, no internship, etc).

If the guy ends up being a high performing competent contributor, he is almost guaranteed to be asked back the next year!

If you’re interested in getting one of these job, how can you do it? It’s the same process I recommend in my course How To Find Any Accounting Job in 3 Months Or Less!

If you’d like to know more directly from me, or would like help reaching out to a firm, email me at andrew@thebeancounter.com.