I was recently asked what my biggest piece advice for recent college grads would be.

While I don’t think of myself as an old geezer giving advice, I gave it a try.

1. Don’t live with mom and dad

Seriously.

Baby bird needs to fly from the nest. Time to grow up.

I know you want to save a few thousands bucks a month, but it’s not worth it.

Even if you have student loans.

You need to experience what your personal economic circumstances are and how you can improve them.

Your future boyfriend/girlfriend/husband/wife will thank me.

Mature, successful, accomplished individuals don’t live with mommy and daddy.

2. Start a side business with less than $500 start up money

This can be a new hobby.

Think catering Saturday football games, or becoming an Uber driver.

What is something you can do to experience what it’s like to be an entrepreneur rather than an employee?

This will help you empathize more with any entrepreneur clients you have and inspire you to think about business, not just busy work you are assigned in the early days of your career.

Not to mention, you can make a little money!

3. Get on a budget

I’ve shared how we managed to pay off $55,000 of student loans in 14 months.

That was largely because of doing a written budget every single month.

When you sit down and look at every single transaction, you realize you are killing yourself a 3-4 pointless purchases a day.

$27 at a baseball game

$77 night out with friends

$17 new music that came out

That adds up! That’s over $400/mo and you’re probably doing more than that!

I’m not against enjoying money, I just want you to have a conscious plan about how much you’re going to spend.

Making and reviewing a budget is the best way to do that.

4. Get on a plan to get promoted

Not 3 months before year end. Day 1 of your new job.

Getting promoted is a multi-year effort and is MUCH easier if you do a little bit each month.

Working on 1 extra project not assigned to you per month means 12 after a year!

That looks damn good for year end reviews.

See my recent webinar: How to Guarantee Your Public Accounting Promotion

5. Pay of student loans in 3 years or less

Income – Expenses = Money to be saved or applied to debt

What does your equation say?

Debt / Money to be applied each month = number of months until you get out of debt

Make that number less than 36. Preferably MUCH less.

We cut all non-essential expenses and increased our income by working 3-4 different jobs. But hey, now we’re DEBT FREE!

6. Create a personal brand online

Even if it’s just LinkedIn. Although I would also recommend twitter.

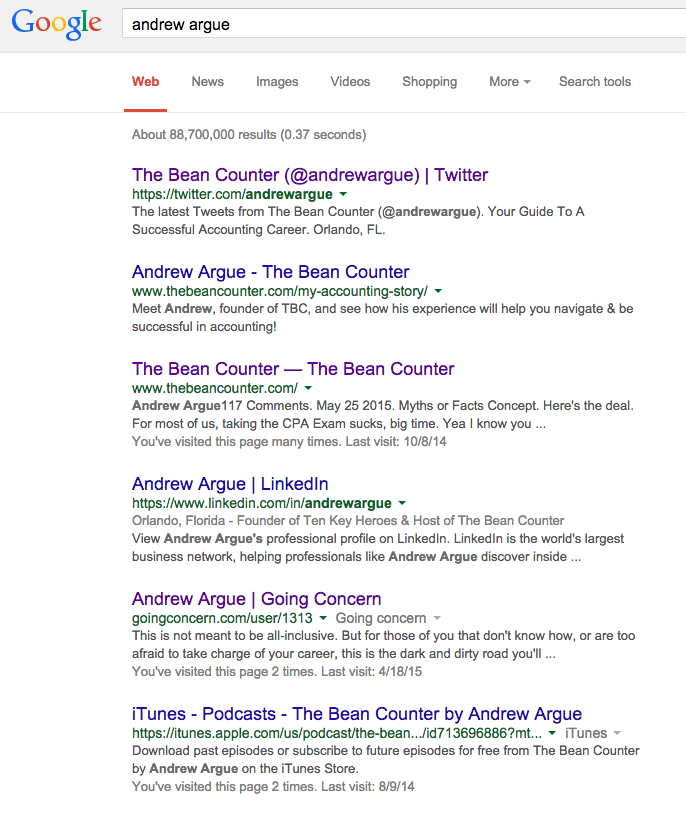

This is at the very least damage control for anyone searching your name on Google and for people like me: LIFE CHANGING.

I have a very different life now. All because I decided to put myself out there, openly, and honestly.

Not to mention I control Google 100%. Look what happens when you Google me?

7. Make a plan to find a spouse

Most people meander through there 20’s (and honestly even 30’s) without any real game-plan to find a spouse. If you don’t want to get married, fine.

But…

If you think you want to one day, don’t you think you should have a plan?

I mean, they do play a MASSIVE role in your life.

It’s not always easy to find a great spouse. The dating scene can be tough and you may not live in the best area. All the reasons to start early.

Get involved in your community, play pick-up beach volleyball, hang out at coffee shops.

Tinder and plenty of fish may be fun, but there is an immediate/short-term view on those things.

If you know what I mean.

When you are on your first date, ask real questions. Share your response as well.

- Do you want to have kids?

- How much debt do you have?

- What are your parents like? What is your relationship with them?

- What religion are you (if any at all)?

- Can I kiss you? (yes, asking is still a turn on and sign of maturity)

No I wouldn’t pepper these questions at the other person before the appetizers arrive, but I would slowly make your way to them.

Why waste your time with a loser.

8. Never lease a car

Want to stay poor?

Live on a credit card, lease a car, and pay minimums on your student loans.

Remember that old capital one commercial?

That viking guy says: “what’s in your wallet?”

What should be in your wallet: cash.

Simple as that.

No you do not deserve a $25,000 car because you work in the Big 4.

I don’t even own a car currently and my last car was purchased for $6,000 and sold for $3,700.

It honestly sucked, but I shave off $55,000 in debt when I had that car, not bad.

Leasing is just another form of financing (debt) on an asset that is plunging in value.

You want to take out debt? Fine. But don’t be a fool like I was and do it on something where the value will go down. Remember this:

- The effective interest rates on leases is usually over 15%

- It’s very hard to get out early without paying thousands of dollars

- You don’t own the car at the end.

Don’t get ripped off, pay for whatever car you want in cash only.

9. Get the CPA done if you haven’t already

This is the #1 thing I see holding people back from getting promoted.

Not only does their firm require it for promotion, but it is dragging them down.

They work all day and instead of enjoying the freedom of being a working adult, they start studying from 7-11pm.

Then they have to come in the next day and compete with someone who went on a date, or relaxed at home watching Netflix.

It’s not hard to tell who is happier, works harder, and more likely to get promoted.

Get the CPA done as soon as possible!

10. Exercise more, drink (alcohol) less, and eat well

While I’m only 25, I wish I would’ve learned this sooner.

We have the chance to live to be 100 nowadays. Are you going to do it?

Make a conscious effort to be healthier now will save you thousands of dollars and years of your life in the future.

We all know it: Prevention is better than cure.

What did I miss? Any advice you would recommend? Let me know in the comments!