The Bean Counter Interview

Kristin Pizzi

Kristin Pizzi falls into that category. Kristin is a Senior Manager at Marcum LLP, and we got together to discuss her experience that led to Marcum and some interesting projects she has had the flexibility to pursue, while working for the firm.

To listen to the entire interview, see to the right.

-

Intro: Do you have a job in accounting? Are you looking? Whether you’re starting from ground zero in university or are crushing it with your full time career, the Bean Counter is the show for you.

Here is your host, Andrew Argue!

Andrew: Good morning, everyone! Thank you so much for tuning in to this episode of The Bean Counter. I’m your host once again, Andrew Argue. Today we have Kristin Pizzi on the line from Marcom CPA. Kristin, thanks! Did I say your last name right?

Kristin: Yes!

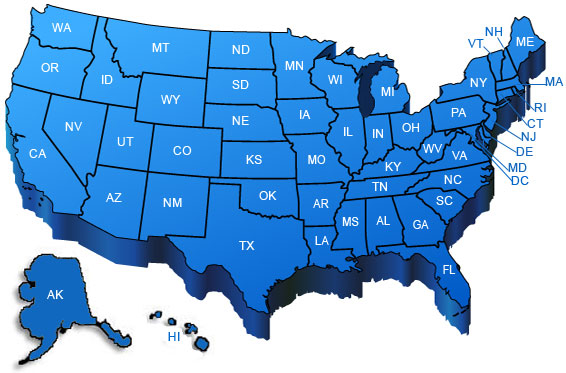

Andrew: Okay, perfect! Tell me a little bit about Kristin. We met over the internet like I meet pretty much everybody nowadays. I was excited to hear about your background. Marcom is not huge down here in Florida so I’ve never met anybody from Marcom. Tell me a little bit about the firm. Where are you guys located, if someone wants to get involved?

Kristin: We do have options in a bunch of states. I can’t name them all off handed but we’re national service. We have an office in China. We actually do have a couple of small firms on the south coast of Florida but we are a national firm.

Andrew: Perfect! Okay, cool! That’s great! Tell me a little bit about your background. Where did you go to university? Where are you from and where are you living now?

Kristin: I was born and raised in Belmont, Massachusetts. I went to Bentley College about a mile down the road from where I grew up. I went there for both my Bachelor and my Masters degree, both in the county. I’m a CPA in the state of Massachusetts and in the past I’ve worked for various audit firms in the enterprise, private fellow, being SET reporting and as a senior accountant. However, I did get bored in private and decided to go back in a public company so I’m currently a senior manager at Marcom.

Andrew: When we were starting to get to know each other you told me that you also do some CFO consulting as well. Tell me a little bit about that.

Kristin: Using the skills that I learned at Marcom and throughout my accounting career I do a little bit of consulting services mostly for smaller businesses in the trade because a lot of those businesses are seasonal so they kind of need someone to help them forecast cash and just managing money is a big issue especially in today’s economy. I provide CFO services as well as bookkeeping. I’m working on my QuickBook certification right now.

Andrew: Do you take weekends off? You got the full-time job and you got the consulting, too. That’s interesting.

Kristin: I find CFO consulting a little bit more rewarding just because a lot of the clients are smaller and they’re a lot more few strokes. I also learn a lot too, as well. I love to work, I’ve always been kind of a workaholic. I’ve worked since I was twelve so it’s kind of just in my DNA.

Andrew: That’s awesome! When we ask these questions, as we go through the podcast, feel free to draw upon either the CFO experiences you’ve had or your public and private experience as well.

With that in mind, tell me about one time in your career that you got really excited about accounting, maybe you’ve made an impact or maybe you’re really just excited about choosing this as a career.

Kristin: The way I fell into accounting, I went to Bentley – if you’re not from the area, it’s a business school. You’re either going to major in accounting, finance, economics. Majority of the people majored in accounting and I actually went to say, “I’m not going to major in accounting. I’m terrible at math” because I actually am not great at math. I was talking to one of my career coach, he’s like, “If you were in accounting you can work for me” so that kind of sold me.

It’s really hard for me to pick one specific experience but I do work with a lot of smaller clients right now, especially with my CFO and bookkeeping services. They need some handholding for the most part very grateful for what it is you offer. It’s kind of reward to go to work every day with a small crew of people like, “Hey, I have a text question can you answer? I have a question in Math, can you answer that?” I won’t say one specific reason -

Andrew: Yeah. Tell me, if someone is interested in doing some of that work on the side, what level of your career did start doing that? How did you get involved in it?

Kristin: I started at POBC. To be honest, even as an auditor, I don’t think you’ll have experience as a bookkeeper until you actually go into private. The fact that I went to private, they actually helped me because I didn’t understand how it works. If you make an entry one way, it could affect something else. It’s hard to do that in audit unless you have a couple of years. If you go into private, you work on closing the books so you pick it up a little more quicker. To be honest, I went back into public accounting because I love the work. I look at the companies and kind of being pigeon-holed and do these kind of payables, or something very specific and that’s why I went back into public to get more experience. When I went back to public I actually missed the bookkeeping part of it so I try to do that on the side. It took me about six years into my career.

Andrew: Did somebody say, “Hey, I need some help” and you sort of fell into it or did you go out there? Were you determined to do it because of something you always wanted to do?

Kristin: Yeah. I was determined to do it because there are separate minds but I wanted to do bookkeeping on the side. The company that I worked for before I went back into public went bankrupt. It’s one of the reasons I actually went into public, I knew I always have a job if my company went under. Basically, the old CFO or CO starting a new company say, “I just need someone to come in and do the books for a couple of days a week.” I said, “Sure.” I kind of liked the side job so I just look up jobs on Craigslist and pick up a couple of clients.

But now I do BNI which is a business referral networking. Basically, you meet once a week, face people in different trades. What it is is one person from each trade is the chair in that BNI chapter. There are chapters all across the United States. I don’t know if you’re heard of them in Florida, but there is a bunch. I’m doing that and I’ve gotten work there as well.

Andrew: Interesting. I haven’t heard of that. You said it’s called BNI?

Kristin: Yes.

Andrew: I’ll have to check that out.

Kristin: I think it’s Business Network Institute. It’s about a couple hundred dollars a year to join. Every Tuesday you give a sixty-second presentation of what you do. Basically you’re just like everybody else, trying to find another job. We have appointment in the groups and anytime we need something we call him up. Pretty much every trade has a chair.

Andrew: That’s interesting!

Kristin: There’s only one person allowed for every chair. I’m the bookkeeper and we also have a tax person.

Andrew: That’s great! That’s an interesting little set up how there’s one person for every trade. I’ll definitely check that out.

Another question we ask – you’re sort of touched all different sides of accounting, public, private, your own sort of consulting. Tell us about one failure that you’ve had in one of these endeavours. We always ask people who’ve done really well in accounting sort of humble themselves before us, if you will.

Kristin: Of course. To be honest, there’s too many so maybe no. The biggest advice I can give to people is not to give up. Just because one job doesn’t work out the way you intended. Like I said, I finished the entire seven, it’s just that it didn’t work out. It doesn’t mean you’re a failure. That’s the advice I would give people that makes mistakes. Go through them again and move on. In business you’re bound to make mistakes, everyone does. It’s actually very common that the signs get missed, things are missed. We are human so mistakes are bound to be made. The biggest thing I could share is just go through the mistakes and go through all of them.

Andrew: Yeah.

Kristin: If you’re in college and you share a few views, it’s very common.

Andrew: Yeah, absolutely! Tell me, is there a great resource that you use along the way? Maybe a publication or something that you draw upon? You mentioned BNI, but is there something else you can think of that’s really helped you over the years?

Kristin: Yeah. I would say other people; find a mentor. I always talk to other people, especially just say, “How are you doing?” I think that they liked that. As a senior manager I love it when someone comes to me and ask, “What can I do? What can I work on?” It’s very hard to do as well, it’s very uncomfortable to ask, “How am I doing?” to ask for a feedback but it’s something that you should do for personal development.

Andrew: Yeah, absolutely! I think that that’s great. We hear that a lot, finding someone that’s your cheerleader, that’s in your side of the bench, supporting you can be hugely helpful. What about for someone who’s just starting out in their career? Someone who’s getting ready to graduate university, first or second year new fresh accountant? What’s your biggest piece of advice for them about the future?

Kristin: I would say the same advice as before: find a mentor or two. Find someone older than you. If you go into private, it will probably be a boss and if you go into public it will probably be any of your seniors that you work for.

What I tend to see is a lot of people find that person that they continue to have work on them if they’re in public. They just try to pick them up and they just try to really develop them.

Andrew: Yeah. What about for someone who’s a little bit further on in their career now? I know you’re held a number of different positions and you also do the CFO roles for small businesses. What’s your advice for someone who’s further along in their career and wants to maybe do something on the side or wants to break out and make a change? How should they be thinking about – let’s say after five years – how should they be thinking about the next five years? How should they get involved in something that is important or interesting?

Kristin: Do your research, number one. I always say before you take the next step, don’t just act on an impulse. Many accountants are very visible from January to February and they always say, “I’m going to quit”. They go somewhere and they think the grass is greener but then summer time comes on and it’s like, “The job’s not bad.”

I always tell people to speak with a clear mind and don’t be impulsive because if you’re impulsive you’re just going to make the wrong decision.

The best advice that I did receive from someone was to act like the day that she want to get eventually get. If supervisors dress up then you should dress up. Meet with your boss often after he came back. I’m sure your boss would appreciate it.

Andrew: Yeah, absolutely. We always sort of finish up the podcast with the same final two questions. The first one is what’s a great book that you’ve read that you would share with everybody else that you recommend?

Kristin: I actually don’t read a lot of books. I’m bound by my computer a lot and I’m a very energetic person so when I have time I want to be outdoors and go and enjoy doing stuff. I can’t even tell you the last time I picked up a book.

Andrew: No worries! Something else, maybe? Maybe a website or a publication or a blog? Is there anything else that’s been sort of helpful to you?

Kristin: To be honest I like the QuickBooks certification blog, it’s very helpful. To be honest, YouTube is very helpful. If I have a question about doing something on QuickBooks, YouTube’s helpful. Go to the internet. I’m Senior Manager at Marcom, sometimes we get data and I don’t get it. I just go on Google and try to find a resource that’s good. Then I go back to the guys and go from there.

Andrew: It’s amazing! I feel very similar. I’m sort of happy that the internet exists in my lifetime because I don’t really love reading books either. I love using the internet – things like YouTube – to get knowledge. It’s funny, I was asking a partner the other, he’s like fifty-five years old. I said, “What did you guys do before the internet came out to look at public company financial statements?” I swear, the guy couldn't even answer it. He said, “I think we had to make a request via mail.” I was like, “That’s just insane” because now you can just Google all those things. It’s crazy how much that’s changed everything for us.

Go ahead.

Kristin: We’re definitely spoiled.

Andrew: Oh, yeah! Absolutely! The last thing I want to ask is you could share a quote with us that’s helped you reach your goals and why it’s important to you.

Kristin: I’m going to go to an old Warren Buffet quote. He says, “Look for three things in a person: intelligence, energy and integrity. If they don’t have the last one, don’t even bother with the first two.”

Being in accounting, your integrity is extremely important. It’s not even just doing good work, just keeping promises. Obviously some things happen sometimes and it doesn’t come up. But if you’re consistently over-promising and under-delivering then people just don’t see you as someone reliable. When I raise the deadline for my boss, I would tell them, “I’m going to get this to you by this day” and I will get it to them by that date. If I can’t I will give them an estimate and say, “Something came up.” If you’re in public people will come up to you all the time. Every now and then I look at public companies and something will come up out of the blue, and SSC current letter and you just have to drop what you’re doing to work on it to get it done because you have to type that line for acquisition or something. If you know to keep your promises, people trust you. If you do good work people will trust you. Integrity is extremely important.

Andrew: Yeah. I’ve never heard that quote. I appreciate you sharing that.

The last thing is if someone wants to get in touch with you, maybe they want to learn more about how you started your bookkeeping CFO practice, or they want to learn more about Marcom or they just want to reach out and ask you a question, what’s the best way to get in touch? LinkedIn, Twitter, email? What’s the best?

Kristin: Email, phone or anything, I’m pretty open to it.

Andrew: Cool! I will link your contact information down below for anyone that wants to check it out.

Kristin, thanks so much for coming on the podcast. I think it’s awesome that you started that little practice on the side. I know a lot of people that are interested in doing that and I like that you’re sort of public about it. I saw that it’s on your LinkedIn. It’s cool that Marcom also supports you and allows you to do that as well.

Kristin: Right. As long as my clients do not compete with it which usually they’re not. They’re a lot smaller space-like kind of work.

Andrew: Cool! Thanks again so much for coming on! I hope that we’ll keep in touch. If anybody has any questions for me, you can reach me at Andrew@thebeancounter.org. Thank you so much for tuning in and I will talk to you soon!

Kristin: Thank you so much!

Andrew: Thanks!

Kristin: Bye!

CPA Exam & Starting Bonus

CPA Exam Policy

Reimburse Exam Costs: Yes

Reimburse CPA Review Course: Yes

CPA Passing Bonus: Yes

CPA Passing Amount: Unknown

Starting Salary & Where to Apply

or

Students: Apply with local HR. Find them here.

Marcum Locations

Key Recruiters

Reaching Out to Marcum

Getting in the door at Marcum and the rest of the top 25 firms can be tough, but if you approach it the right way, it's really not that hard.

For a firm of this size, there isn't a key recruiting contract that will work for you anywhere in the country. That will change as we go down the list of top firms.

With Marcum, you're going to have to do some research.

The good news is that I'll walk you through step by step how to target specific recruiters and firm staff, and exactly what to say to get your foot in the door! You can also get in touch with the National Recruiting Leader as a last resort if you haven't been able to hear back from any local HR.

*Acquired by KPMG

**As ranked by Accounting Today