The Bean Counter Interview

CBIZ Interview

Dave Enick is a Managing Director / Shareholder at CBIZ in Tampa, FL. Dave was kind enough to join The Bean Counter to discuss his career in accounting and now with CBIZ as well as the flexibility his firm has given in pursuing new service offerings to clients!

To listen to the entire interview, see to the right.

Intro: Do you have a job in accounting? Are you looking? Whether you’re starting from ground zero in university or are crushing it with your full time career, the Bean Counter is the show for you.

Here is your host, Andrew Argue!

Andrew: Good morning, everyone! Thank you so much for tuning in to this episode of The Bean Counter. I’m your host once again, Andrew Argue.

I have a very special guest today. I’m in the Tampa offices of CBIZ KRMT. I’m meeting today with Dave Enick. Dave, thanks for coming on.

Dave: Thanks for having me!

Andrew: Let’s start off with for the people out there that don’t know you, tell us a little bit about your background. Let’s start with where you’re born and then let’s come all the way up to what you’re doing today with CBIZ.

Dave: Sure! I’m born and raised in Pittsburg, Pennsylvania and really chased the weather south from there. I went to school at Wake Forest University. From there, I went to Atlanta, spent a couple of years with Ericson Young in Atlanta. I moved down here to get married about seven and a half years ago now. I went to interview with Deloitte, I had a very good friend from school there. I spent a couple of years with Deloitte as lead manager.

Andrew: Down here in Tampa?

Dave: Here in Tampa, yeah.

Andrew: Okay.

Dave: It’s just been over four years now at what KRMT now CBIZ KRMT.

Andrew: Here at CBIZ, what are sort of the clients that you work on from an industry perspective? Give us a feel also for the size of CBIZ KRMT. What type of industries are you guys covering? Give us a feel for the size of the company.

Dave: Sure! We’re about ninety professionals all in and industries across the board, everything other than banking and insurance. We’re really staying away from statutory accounting and any sort of banking regulations. We break ourselves down with services, manufacturing, auto dealers, SEC, a number of different practices. I spend almost my entire time focused on private equity so private equity portfolio companies and then leading out our transaction advisory practice effort which we leave a lot of emanate, due diligence, financial transactional tax, specifically on the by side.

Andrew: Okay, cool! Tell us a little bit about how many clients you have in a year. What does your portfolio look like?

Dave: I probably range anywhere between a dozen or fifteen to eighteen depending on the year and a lot of that depends on the volume of the transaction work and whether that’s going to get peak or off-peak hours. That’s fairly consistent for folks around here.

Andrew: Cool! The first question I always lead off with to get the stories going is tell us about something in your career that happened where you are really excited that you chose accounting and you knew that this was something that you are happy that you made the decision.

Dave: 2013 has probably been a banner year for me. From an excitement standpoint it’s been really cool as part of a national firm now but really this local presence that has been KRMT for a number of years. We have really built out our efforts in the transaction advisory space and something with the big four background. I was fortunate enough to have some experience in. We have a number of folks here with that similar background. We really have done a great job from a grassroots perspective of going to market this year, very strong to build out our capability in that transaction advisory state. We’re very fortunate in a market like Tampa to see so much private equity money coming here into town and folks here in town investing that money elsewhere. I’ve had a great time, put together a little bit of a business plan and really gone to market with a consolidated strategy. We really took some work that we have been doing over the course of time and have made that a focus here for the practice going forward. I’m very lucky for the opportunity to get to lead those efforts from our end here in Tampa.

Andrew: A lot of people that are just starting out, a lot of people listening to the podcast are in university or just starting out in their career. One of the big questions people have is what are the benefits or going to a large firm and being a public accountant versus a middle market or a small firm? When you’re sort of talking about being able to put together a business plan and going after a new market, that seems like a lot of flexibility here. Can you tell us if that’s one of the benefits working here versus one of the larger firms? Not to bash one company to the other, but just to give us the feel for people that want to know what choice they should make.

Dave: Absolutely. That’s a great question! It’s a great point to make. I had a fantastic at both of the big four firms where I spent time. They really did such a fantastic job of getting me prepared to be the professional I am today. As I came over four years ago, I looked at KRMT on just an entrepreneurial spirit that permeated the culture around here. I was very, very attracted to that and it certainly gives you a lot of options and a lot of leeway and the opportunity to really take ownership of your career. We have been very, very fortunate going through this CBIZ transition that it’s been very business as usual, that we still have a large degree of autonomy but we really have been backed by some of those national resources. What I encourage students to do out there who are looking at their different options as they’re coming out of school is to really evaluate what they want to get out of their career and use someone like me as an example that you don’t have to know exactly what you want right away, that there are a number of different paths you can take within the industry and be at the technical depth you get at a big firm or the breadth of experience you get at a smaller firm where you can really carve your own path. Andrew: Cool! I think that helps a lot. One of the questions we ask people who come on the show, a lot of people come on have been very successful. We like to humble them a little bit. And because some people are younger they see people that are successful and they don’t necessarily see all the struggles along the way. Tell us about what has been your biggest failure or just share with us one of the failures that you had getting to where you are now. Dave: Sure! I think as I look back, I honestly say I think it was the biggest, and unfortunately I wasn’t smart enough to realize it until it was too late. As I made the transition out of big four I decided to come join KRMT. My wife and I decided that we are really committed to Tampa, I wanted to put roots down. I got here on Day One, looked around and talked to some folks and realized very quickly that I have been completely deficient in building out my network and really getting involved in the community here in Tampa in any way, shape or form during the first two and a half years that I had spent here. I came to realize very quickly how far behind I was because I hadn’t prioritized my network or getting involved in the community and really felt like from that point forward I had to play catch up to get myself up to speed to be in a competitive environment like this, trying to make partner in something that was really important to me.

Andrew: Yeah. You started talking about putting a business plan, going after a new market, a lot of times when you do that the connections are a huge piece of that. Give us an idea on what are some of the things you did that worked in terms of building that network? What are some of the actions that you put together and you executed on?

Dave: I was very lucky in that somebody sat me down early on and convinced me that what I needed was a plan. It didn’t have to be a great plan and I didn’t have to stick to it but I needed a plan. From that perspective I decided early on that I was going to be very, very intentional and I was going to be very focused. I got very, very fortunate I was turned on to a great work in town, the Association for Corporate Growth which is an international organization really focused around middle market MNA activity and something that fit right within my wheel house. I was very lucky they were accepting, they’ve even gone out to build out here in Tampa an emerging professional’s chapter that’s geared towards the under-35 crowd. My wife and I had a real opportunity to get involved. We’re both really involved with the YMCA as well so I had an opportunity to join the board of advisors for the First T of Tampa Bay which is a joint partnership between PGA Tour here in Tampa and the YMCA and really teaching life lessons through the game of golf and the nine core values that we’re teaching kids. It’s giving me the opportunity to get out and give back.

Andrew: You play golf?

Dave: I do.

Andrew: Okay! Do you get to sneak out every day at three and hit the range? What is the firm’s policy here?

Dave: Definitely one of the perks! As long as you can somehow tie it into network -

Andrew: I see where you’re going here. You’re saying, “I have to meet the clients at the golf course.” I see how it is.

Dave: Especially if they set the meetings. I’m somewhat at the mercy of those folks. Andrew: Yeah. “I’d love to get this work done, but really I need to cater this. This could be a big job here.”

Dave: You never know! That has been part of the fun of joining the firm, just a different approach that we’ve taken to things, whether it’s networking at a golf course, whether it’s building out a business plan, whether it’s digging into some typical issues with middle market clients. It really has been a nice plan.

Andrew: Tell us about one of the challenges that you met maybe early on in your career and how you’re able to come out of that. I know you mentioned the networking piece, but if you could share with us something else.

Dave: I guess the big challenge probably ties into my biggest failure, realizing that, ‘Here I am, I’m a manager at a public accounting firm and I have no network so to speak.’ I wasn’t raised here in Tampa, I don’t have any family in town. I quickly had to get myself up to speed and I had to do that on what was already the transition years of learning a new firm, a new culture, a new software and things like that. I was very fortunate, again, to get some good and hard advice early on and to put a plan in place and to really prioritize relationships and not to think about it from a networking or business development perspective but to start to put relationships first and realize that there’s an equal balance of the technical component and the human interaction component of what we do.

Andrew: Yeah.

Dave: It was a tough first eighteen months, making the transition to try to get the network up to speed but really lucky. It’s been a lot of momentum and as you start to have a little bit of success, getting out and getting involved, you have more opportunities that just happen to follow your way.

Andrew: I know I mentioned there’s a younger crowd, but we do have people that like to hear the stories from people that have done well in accounting. They’re in accounting themselves and maybe they want to build their network like you. They want to go out there in the community. How do you convert that into business for the firm? Some people find that to be a bit of a challenge from a perspective of meeting someone at a networking event and whatnot and sort of, “Hey, do you guys need a review? We do reviews!” It’s not like you can just sell them like the Oxyclean guy at night on commercials. How do you build the relationship and transition eventually into those types of conversations? What are your tactics for that?

Dave: CPAs by nature are not the most extroverted, outgoing people so certainly it is a challenge. I’m fortunate enough to speak at our summer leadership conference and did a little piece on networking and got to talk to the same topic. I think the key is to not look at it as a business development exercise. What you really have to do is find things that you’re interested in, find ways that you want to get involved and give back to the community. You have to make it personal, you have to make it intentional but most importantly, you have to make it fun. What I have found to be really successful is setting some very small goals early on and letting the momentum really build from there, that law of compounding returns. If you set out to really try and give back and be intentional about helping others people, whether it’s companies not for profit or individuals out in the community. I think if you put the other person first and you really put yourself second, then that business development that’s going to fall on the firm, that really is just going to be an indirect benefit of all the efforts that you’re putting forth. That being said, it’s a big exercise in patience because it’s a really critical part to succeeding in any sort of service firm today, not just the CPA firm. The tendency is you want to rush it. You really have to be patient and be intentional and have fun.

Andrew: Yeah. From what I’m hearing you’re sort of focused on relationships with these people first, get to know them, maybe skip on work to play golf with them and then it sort of happens because they trust you. Maybe something comes up in their business and you can go from there.

Dave: I think you’re exactly right. It just happens; it’s doesn’t happen overnight, it’s over time. You just continue to invest and let good things come to great people.

Andrew: Nice! Okay. I think that that’s very helpful advice. One of the things we ask about people who have been successful is what’s a great resource that you use? Maybe someone out there can go and implement today? Something you read or something that you’ve kept along with you, a journal? What is something that you’ve done to utilize resources?

Dave: Reading is fantastic and I don’t think anybody can get enough of that, the self-education, especially on topics you’re interested in. I think, far and away for me, one of the biggest benefits in such a young industry as public accounting are the various mentors I’ve been able to encounter and engage over my career. I really want to encourage people, as they’re starting out, it’s not just one or two and it’s not such a formal process but it’s really gravitating towards people who do business in a way that you admire and that you want to do business going forward and really spending time with them, being intentional and making sure you take away things from the way they carry themselves, the way they represent their personal brand and the brand of the firm. You just take that blend of styles and skills and experience from various mentors and you let that help create what your own style would be. Andrew: You don’t need to go into any details if you don’t want to, but can you give us an example of one of the mentors that you had and what was great specifically with one of them?

Dave: Yeah. I’ve been very fortunate to have a couple of fantastic ones across my career. One of the things that I was very, very deficient, I realized, in becoming a manager was putting that relationship first. I had a very, very deep technical understanding but I had no network. I was out of balance and I was very, very fortunate to have someone here at the firm – what was KRMT at that time – kind of sit me down and really just tell me the story about their career path, what it was like coming out of big four, what the transition was like for, what some of their struggles were and enter the dialogue a lot about some diverse strengths that different folks had around the organization and how it’s not so much about being all things to all people but figuring out what puts that fire in your belly, what gets you excited to get out of bed every day, not just at this point in your career but project forward for the duration of my career and really gravitate towards those types of things. I was able to take from this particular mentor this concept of what I call horizontal specialization where any of the big firms today, you go to their websites and they really look at things vertically in its industry.

Andrew: Yeah.

Dave: Industry verticals all across the board. This particular person had taken a really unique approach where they had taken what I call more of a horizontal approach to things and said, “I’m not going to be alone in the street or one specific thing. I’m really going to build out kind of a technical niche that I’m really excited about that I can apply across all industries and build my platform around that.” It’s been four years in the making but that really was the initial driving force behind the business playing to go forward with our transaction, the binds that we practice is we get a more horizontal approach and industry agnostic but really focusing in on the key area that I’m excited to be a part of.

Andrew: Yeah! It’s interesting that you mentioned that and that sort of makes sense because of some of these large firms that are international have thousands and thousands of peoples that work for them that they could afford to do that. But if you’re in an area and you have very diverse clients and not as many people, that makes sense. I’ve never thought of it that way, going horizontal rather than vertical from an industry perspective and technical expertise so I appreciate you sharing that.

Dave: I should point it out, in a middle market like Tampa, it really, in my opinion, is the way to go.

Andrew: Yeah.

Dave: There just aren’t enough major clients in a single industry to sustain the growth and the professional development in the career that’s challenging enough to the young professional.

Andrew: It’s interesting too from a marketing perspective when you share that versus how so many people will say, “I’m the best guy in this industry” but if you market yourself as that and people aren’t looking for that or there’s not a big enough market to support it then you’re really going to run into a problem there. I do like that. It’s definitely something unique.

Andrew: I know you mentioned you speak at the summer leadership conference. Tell us about what your biggest piece of advice is for people just starting out, maybe in university, maybe in their first year?

Dave: It’s going to be more do as I say, not as I do. Seek out those mentors early on in your career, don’t just let them fall to you, really be intentional about trying to engage. That doesn’t have to be at the partner level, those are going to be people at all levels of the organization. Try and learn from their experience and their style and their skill set, take from that the pieces that you really like and really that define who you continue to evolve to be as a professional. There’s no better way to learn, I don’t think, coming right out of school and job and into a public accounting firm than to look up to a couple of folks who you really admire and try and borrow a little bit from each of them as you’re trying to carve out your own style.

Andrew: Perfect! Thank you! You’ve worked in a number of different firms but within the same industry so you’ve had to make that transition numerous times. If there’s someone out there who’s been working for a while and is thinking about going in the industry or thinking about switching to another firm, what is your advice for them on making that decision and going through that process?

Dave: It’s an exciting time so enjoy it! Don't stress out. Folks in this industry have a fantastically transient skill set and they should use that to their complete advantage.

I would say my biggest piece of advice for folks who are in the professional now is really be intentional with your career. Be intentional. Think about what sort of opportunities you want to create for yourself, whether within your own four walls or outside of the organization. At the same time, make sure that you are constantly seeking out constructive feedback. It’s very easy to fall into that trap of everybody loves to get a little pat on the back at the end of the day and an ‘Atta girl’ or ‘Atta boy’ for something that they’ve done well. But really look to push yourself and try to accelerate that learning curve and set yourself apart. Again, do as I say, not as I did. Make relationships a priority. Do it at an early age and realize that as you progress, the skills are going to tip and more of the relationship side is going to be the key component of what’s going to determine your ultimate career path.

Andrew: Okay. Perfect! I think that’s great! We always end off with the same last two questions. The first one I want to ask you about is about a book. What’s a book that you’ve read that you recommend to people out there and how has it helped you?

Dave: A little bit off the wall, except that we talked about my love for golf and it’s sitting back here on my shelf. But I absolutely recommend to anyone – business fan, not just golf fan – Cracking the Code which is the story of the 2008 Ryder Cup. It was a Paul Azinger co-authored book. It really is a management book and it talks a whole lot about what Paul coined as the ‘Pod Theory’. He’s been talented on all the golf channels and all the major gold networks for how he run about putting together that particular Ryder Cup team and treating it as small pods of players. What’s really cool about it and it applies directly to our industry is what he had to do is take a bunch of very high-performing individuals and meld them together for one week as what would be one of the greater US Ryder Cup teams of all time. We’re really not all that different. We have a ton of strong, individual performers in our industry. As you start to meld them together on different teams and transition from one engagement to the next, really important to figure out how to push the right buttons and pull the right levers to get folks really engaged.

Andrew: Yeah. I think that’s a great point! One of the things I’ve noticed a lot of times from people who aren’t conscious about their management style is that when you’re managing other people – correct me if I’m wrong on this – it really is exactly what you’re saying where you need to figure out the different buttons that needs to be pushed for each individual. You, as the manager, are responsible to motivate each of them and they’re all different. You can’t just apply your style to everyone. You need to take who they are individually and tailor it to them in order for it to work.

Dave: No doubt! That’s maybe the most difficult transition, going from that senior to manager level is you’re no longer responsible just for yourself and your output. You now have to figure out how to push those buttons and pull those levers and it certainly doesn’t always work for people who aren’t different from yourself.

Andrew: I didn’t know about the book. I was young when the Ryder Cup was played, I’ll be honest. But I have seen the replays on the gold channels because I’m sort of a golf nut now. This is going to turn into some sort of gold podcast but I’ll have to check out the book as well so thanks for that.

Dave: Absolutely!

Andrew: To end up, if you could share with us a quote that you live by and how you’ve applied that in your career.

Dave: Yeah, absolutely! I grew up in Pittsburgh and was fortunate enough to play hockey there and was able to live through the hayday of Mario Lemieux, of back to back Stanley Cups. The Penguins had a coach, Bob Johnson. His famous saying was, “It’s a great day for hockey.” Bob went through some real hell struggles towards the end of his life but that continued to be his mantra all the way to the end. What I really like about that is it really hits home for me. That outlook is so crucial. If you wake up every day thinking to yourself it’s a great day for hockey or it’s a great day for whatever you happen to have on your plate that day, I really think that sets the table and it gets you prepared for the day. It gets you going on the right foot and it really keeps you focused on what’s important in life. For Bob, that was hockey and for me today, that might be work and tomorrow that might be a round of golf with a client or this weekend I might be spending time with my family. Waking up each day with that ‘It’s a great day’ mentality, I think it’s really crucial to happiness and success.

Andrew: I appreciate that. Did you play hockey as well?

Dave: I did.

Andrew: I did, too! I played for ten years!

Dave: No way!

Andrew: Yeah.

Dave: Absolutely!

Andrew: I played in Oklahoma and I played in North East and Canada and New York on one of those travel teams for ten years. It’s crazy. Where did you play?

Dave: I played in Pittsburgh growing up.

Andrew: Okay. Pittsburgh huge there! People go crazy about it.

Dave: Huge!

Andrew: Especially back in the Mario Lemieux days. Now we’re turning into a hockey podcast but I don’t even care!

Dave: This is good! East High was in the premium back then. My minor claimed to fame here in Tampa now. As I was growing up in Pittsburgh, I actually played on the line of Ryan Malone.

Andrew: Oh wow.

Dave: He was a famous Penguin winger and now plays the Lightning here in town.

Andrew: That’s awesome! Your kids, how old are they?

Dave: No kids.

Andrew: No kids, okay!

Dave: Yeah, it’s just my wife and I. We have a six and a half year old Australian Sheperd; he’s the baby of the family.

Andrew: Okay. I’m guessing he doesn’t play hockey or golf.

Dave: He does not, but he’s a swimmer.

Andrew: He’s a swimmer.

Dave: Yes. Swimming and Frisbee.

Andrew: Okay, sounds good! How can we get in touch with you if someone wants to reach out for advice? Are you on LinkedIn? What’s the deal?

Dave: Yeah, absolutely! I would say LinkedIn is the best way. I’m happy to share my contact information but I think that’s great advice for everyone out there. If you’re not on LinkedIn or if you’re not actively using it, it’s a great place to be right now for professionals out in the marketplace.

Andrew: Perfect! Thanks so much for coming on, I enjoyed it! I didn’t know we’d have so much in common.

Everyone, thanks so much for tuning in. I’ll include all this information in the show notes, including the link to his LinkedIn profile. Thank you so much for tuning in! If you have any questions for me, you can email me at Andrew@thebeancounter.org. Talk to you soon!

CPA Exam & Starting Bonus

CPA Exam Policy

Reimburse Exam Costs: Yes

Reimburse CPA Review Course: Yes

CPA Passing Bonus: Yes

CPA Passing Amount: 2,000

Starting Salary & Where to Apply

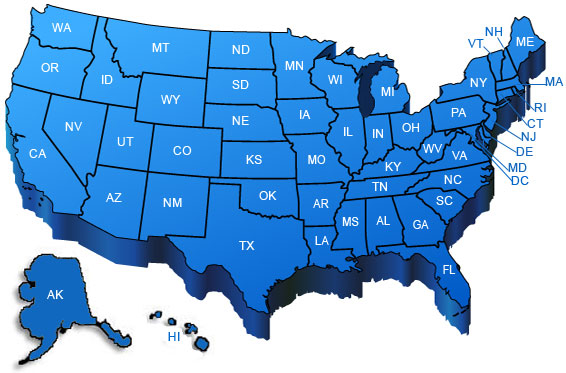

CBIZ Locations

Key Recruiters

Reaching Out to McGladrey

Getting in the door at CBIZ and the rest of the top 10 firms can be tough, but if you approach it the right way, it's really not that hard.

For a firm of this size, there isn't a key recruiting contract that will work for you anywhere in the country. That will change as we go down the list of top firms.

With CBIZ, you're going to have to do some research.

The good news is that I'll walk you through step by step how to target specific recruiters and firm staff, and exactly what to say to get your foot in the door! You can also get in touch with the National Recruiting Leader as a last resort if you haven't been able to hear back from any local HR.